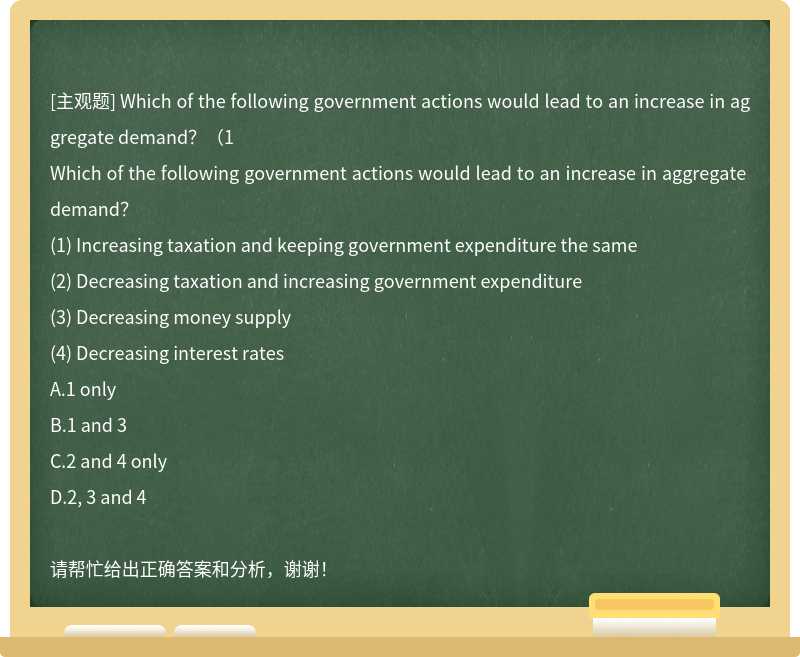

Which of the following government actions would lead to an increase in aggregate demand?(1

Which of the following government actions would lead to an increase in aggregate demand?

(1) Increasing taxation and keeping government expenditure the same

(2) Decreasing taxation and increasing government expenditure

(3) Decreasing money supply

(4) Decreasing interest rates

A.1 only

B.1 and 3

C.2 and 4 only

D.2, 3 and 4

搜題

搜題

第1題

a 1 for 4 rights issue at $6 per share. Its share price on the announcement of the rights issue was $8 per share.

What is the theoretical value of a right per existing share?

A.$1·60

B.$0·40

C.$0·50

D.$1·50

第2題

Which of the following would you expect to be the responsibility of financial management?

A.Producing annual accounts

B.Producing monthly management accounts

C.Advising on investment in non-current assets

D.Deciding pay rates for staff

第3題

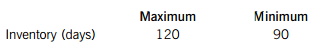

entory days vary throughout the year within the following range:

All purchases and sales are made on a cash basis and no inventory of raw materials or work in progress is carried. Crag Co intends to finance permanent current assets with equity and fluctuating current assets with its overdraft.

In relation to finished goods inventory and assuming a 360-day year, how much finance will be needed from the overdraft?

A.$10m

B.$17m

C.$30m

D.$40m

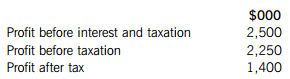

第4題

Peach Co’s latest results are as follows:

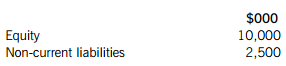

In addition, extracts from its latest statement of financial position are as follows:

What is Peach Co’s return on capital employed (ROCE)?

A.14%

B.18%

C.20%

D.25%

第5題

Country X uses the dollar as its currency and country Y uses the dinar.

Country X’s expected inflation rate is 5% per year, compared to 2% per year in country Y. Country Y’s nominal interest rate is 4% per year and the current spot exchange rate between the two countries is 1·5000 dinar per $1.

According to the four-way equivalence model, which of the following statements is/are true?

(1) Country X’s nominal interest rate should be 7·06% per year

(2) The future (expected) spot rate after one year should be 1·4571 dinar per $1

(3) Country X’s real interest rate should be higher than that of country Y

A.1 only

B.1 and 2 only

C.2 and 3 only

D.1, 2 and 3

第6題

tinue in perpetuity. The company has a cost of equity of 10%, a before-tax cost of debt of 5% and an after-tax weighted average cost of capital of 8% per year. Corporation tax is 20%.

What is the theoretical value of the company?

A.$20m

B.$40m

C.$50m

D.$25m

第7題

Which of the following are descriptions of basis risk?

(1) It is the difference between the spot exchange rate and currency futures exchange rate

(2) It is the possibility that the movements in the currency futures price and spot price will be different

(3) It is the difference between fixed and floating interest rates

(4) It is one of the reasons for an imperfect currency futures hedge

A.1 only

B.1 and 3

C.2 and 4 only

D.2, 3 and 4

第8題

Which of the following financial instruments will NOT be traded on a money market?

A.Commercial paper

B.Convertible loan notes

C.Treasury bills

D.Certificates of deposit

第9題

In relation to an operating lease, which of the following statements is correct?

A.All the risks and rewards of ownership transfer to the lessee

B.The asset and lease obligation will be recorded in the statement of financial position

C.The lease period will cover almost all of the leased asset’s useful economic life

D.The lessor will be responsible for repairs and maintenance of the leased asset

第10題

ital to using mainly short-term variable rate finance.

Which of the following statements about the change in Pop Co’s working capital financing policy is true?

A.Finance costs will increase

B.Re-financing risk will increase

C.Interest rate risk will decrease

D.Overcapitalisation risk will decrease