Peach Co’s latest results are as follows:In addition, extracts from its latest statement o

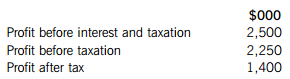

Peach Co’s latest results are as follows:

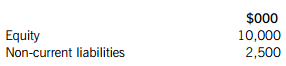

In addition, extracts from its latest statement of financial position are as follows:

What is Peach Co’s return on capital employed (ROCE)?

A.14%

B.18%

C.20%

D.25%

搜題

搜題

第1題

Country X uses the dollar as its currency and country Y uses the dinar.

Country X’s expected inflation rate is 5% per year, compared to 2% per year in country Y. Country Y’s nominal interest rate is 4% per year and the current spot exchange rate between the two countries is 1·5000 dinar per $1.

According to the four-way equivalence model, which of the following statements is/are true?

(1) Country X’s nominal interest rate should be 7·06% per year

(2) The future (expected) spot rate after one year should be 1·4571 dinar per $1

(3) Country X’s real interest rate should be higher than that of country Y

A.1 only

B.1 and 2 only

C.2 and 3 only

D.1, 2 and 3

第2題

tinue in perpetuity. The company has a cost of equity of 10%, a before-tax cost of debt of 5% and an after-tax weighted average cost of capital of 8% per year. Corporation tax is 20%.

What is the theoretical value of the company?

A.$20m

B.$40m

C.$50m

D.$25m

第3題

Which of the following are descriptions of basis risk?

(1) It is the difference between the spot exchange rate and currency futures exchange rate

(2) It is the possibility that the movements in the currency futures price and spot price will be different

(3) It is the difference between fixed and floating interest rates

(4) It is one of the reasons for an imperfect currency futures hedge

A.1 only

B.1 and 3

C.2 and 4 only

D.2, 3 and 4

第4題

Which of the following financial instruments will NOT be traded on a money market?

A.Commercial paper

B.Convertible loan notes

C.Treasury bills

D.Certificates of deposit

第5題

In relation to an operating lease, which of the following statements is correct?

A.All the risks and rewards of ownership transfer to the lessee

B.The asset and lease obligation will be recorded in the statement of financial position

C.The lease period will cover almost all of the leased asset’s useful economic life

D.The lessor will be responsible for repairs and maintenance of the leased asset

第6題

ital to using mainly short-term variable rate finance.

Which of the following statements about the change in Pop Co’s working capital financing policy is true?

A.Finance costs will increase

B.Re-financing risk will increase

C.Interest rate risk will decrease

D.Overcapitalisation risk will decrease

第7題

owing statements is correct?

A.As risk rises, the market value of the security will fall to ensure that investors receive an increased yield

B.As risk rises, the market value of the security will fall to ensure that investors receive a reduced yield

C.As risk rises, the market value of the security will rise to ensure that investors receive an increased yield

D.As risk rises, the market value of the security will rise to ensure that investors receive a reduced yield

第8題

Andrew Co is a large listed company financed by both equity and debt.

In which of the following areas of financial management will the impact of working capital management be smallest?

A.Liquidity management

B.Interest rate management

C.Management of relationship with the bank

D.Dividend policy

第9題

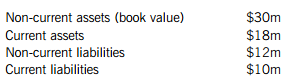

The company has an issued share capital of $1m of $0·50 nominal value ordinary shares. The owners have made the following valuations of the company’s assets and liabilities.

The net realisable value of the non-current assets exceeds their book value by $4m. The current assets include $2m of accounts receivable which are thought to be irrecoverable. What is the minimum price per share which the owners should accept for the company?

A.$14

B.$25

C.$28

D.$13

第10題

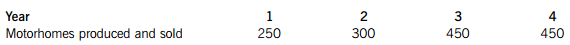

t is planning to invest $4,000,000 in a new facility to convert vans and trucks into motorhomes. Each motorhome will be designed and built according to customer requirements. Degnis Co expects motorhome production and sales in the first four years of operation to be as follows.

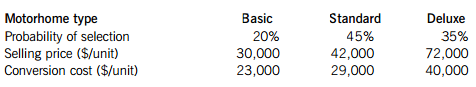

The selling price for a motorhome depends on the van or truck which is converted, the quality of the units installed and the extent of conversion work required. Degnis Co has undertaken research into likely sales and costs of different kinds of motorhomes which could be selected by customers, as follows:

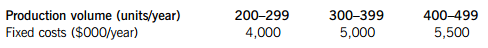

Fixed costs of the production facility are expected to depend on the volume of motorhome production as follows:

Degnis Co pays corporation tax of 28% per year, with the tax liability being settled in the year in which it arises. The company can claim tax allowable depreciation on the cost of the investment on a straight-line basis over ten years. Degnis Co evaluates investment projects using an after-tax discount rate of 11%.

Required:

(a) Calculate the expected net present value of the planned investment for the first four years of operation. (7 marks)

(b) After the fourth year of operation, Degnis Co expects to continue to produce and sell 450 motorhomes per year for the foreseeable future.

Required:

Calculate the effect on the expected net present value of the planned investment of continuing to produce and sell motorhomes beyond the first four years and comment on the financial acceptability of the planned investment. (3 marks)

(c) Critically discuss the use of probability analysis in incorporating risk into investment appraisal. (5 marks)